INTRODUCTION

I was constructive on Oil & Energy for most of 2024 — until July came around, and a major change happened.

On July 20 Weekly Review 13 I wrote: “Oil triggered a new Sell signal — a concern. Gasoline never confirmed a Buy and may be turning down. Energy Stocks still look ok for now, but keep tight stops.”

It only got worse from there.

On July 27 Weekly Review 14, I noted: “Oil fell this week after triggering new Sell signals last week. The breakdown could be an early warning that something BIG has changed. What does Oil know?”

Then on August 3 Weekly Review 15: “A significant breakdown developing.”

From August 17 Weekly Review 17, I added: “Energy remains a mess. There are positioning charts going around, showing Brent Oil positioning at record lows. This has been true for weeks (I even tweeted about it on JUNE 10 near the prior low!). However — WTI positioning isn’t nearly as oversold — at BEST neutral (see chart). So until we can see CLEAR trend signals, buying blindly on positioning may not be optimal…”

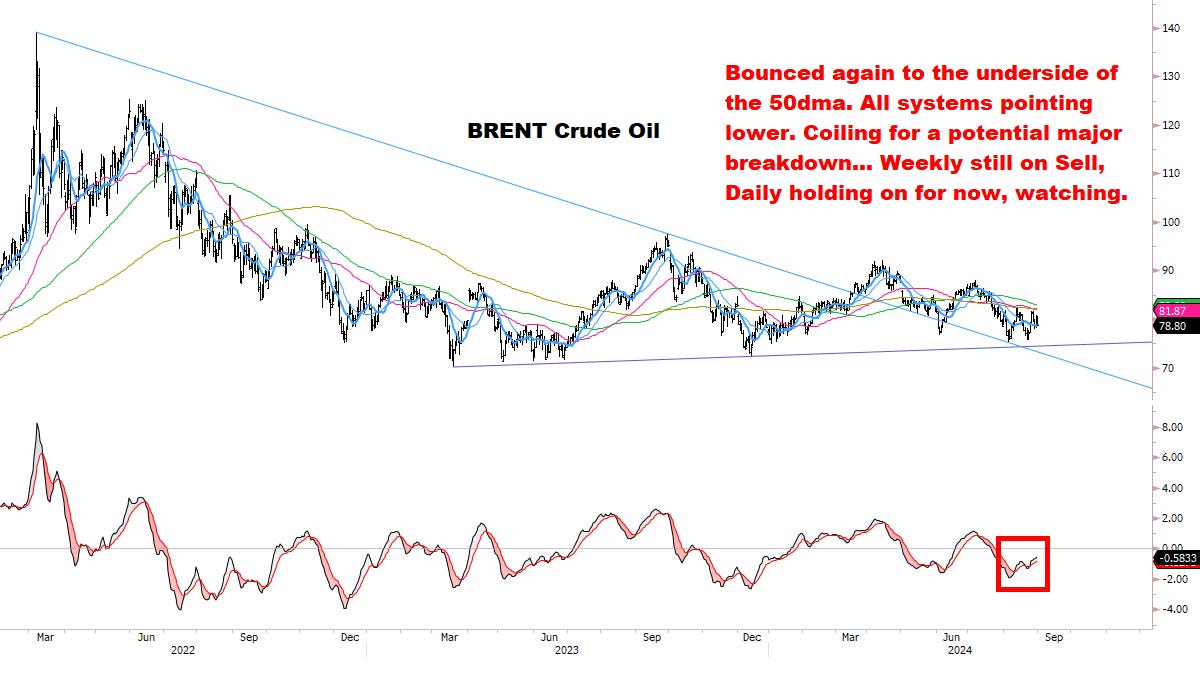

Brent chart published in that August 17 report:

On August 24 Weekly Review 18, I discussed the possibility of a bounce failure and plunge:

On August 31 Weekly Review 19, the bounce was in position to fail and I wrote: “Energy remains problematic, with potential for a full breakdown.”

In the same report, I noted the major Energy ETFS XLE/XOP/OIH were in textbook failure patterns, with potential to plunge — one example below:

By September 4 as published in “Hanging By A Thread”, the collapse had begun:

This wasn’t an overnight surprise — it was a multi-stage collapse.

All along the market was speaking, and Negative Momentum signals were building.

Over the eight weeks from late July until mid-September, the Oil market developed a classic downtrend initiation sequence, which culminated in the recent plunge:

From late July when I began to voice my concerns, Oil prices dropped 22% — nearly $20 per barrel. These are not small numbers for the most important commodity in the world.

Worse, many commodity-focused analysts (especially on social media) have remained steadfastly “Bullish and Bullisher” through the entire collapse, pointing to “Bearish sentiment” and “low positioning” as reasons to catch the falling knife (rarely a good idea).

And on the contrary — as I carefully pointed out in those many reports — sentiment and positioning weren’t low at all.

More importantly, Negative Momentum was in control — therefore stepping aside was essential.

It’s important to remember these concepts — because when negative momentum meets arrogant analysts claiming the market is “wrong”, big losses are usually on the horizon.

Now my spider sense is tingling again, and it’s time to update the scenarios…

Keep reading with a 7-day free trial

Subscribe to Macro Charts to keep reading this post and get 7 days of free access to the full post archives.