Yesterday’s Fed minutes were interesting.

*FED: GREATER INFLATION CONFIDENCE TO TAKE LONGER THAN THOUGHT

*FED: 'VARIOUS' PARTICIPANTS WILLING TO TIGHTEN MORE IF NEEDED

*FED: 'SEVERAL' COMMENTED ON RAPID GROWTH OF PRIVATE CREDIT MKT

*FED: 'A FEW' COULD HAVE SUPPORTED KEEPING ASSET RUNOFF PACE

And the best of all…

*FED: 'A NUMBER' NOTED RISK FINANCIAL CONDITIONS WERE TOO EASY

You don’t say.

The Fed may look right to acknowledge this, but as the title of this post goes, it seems a little too late.

“It’s all good until…”

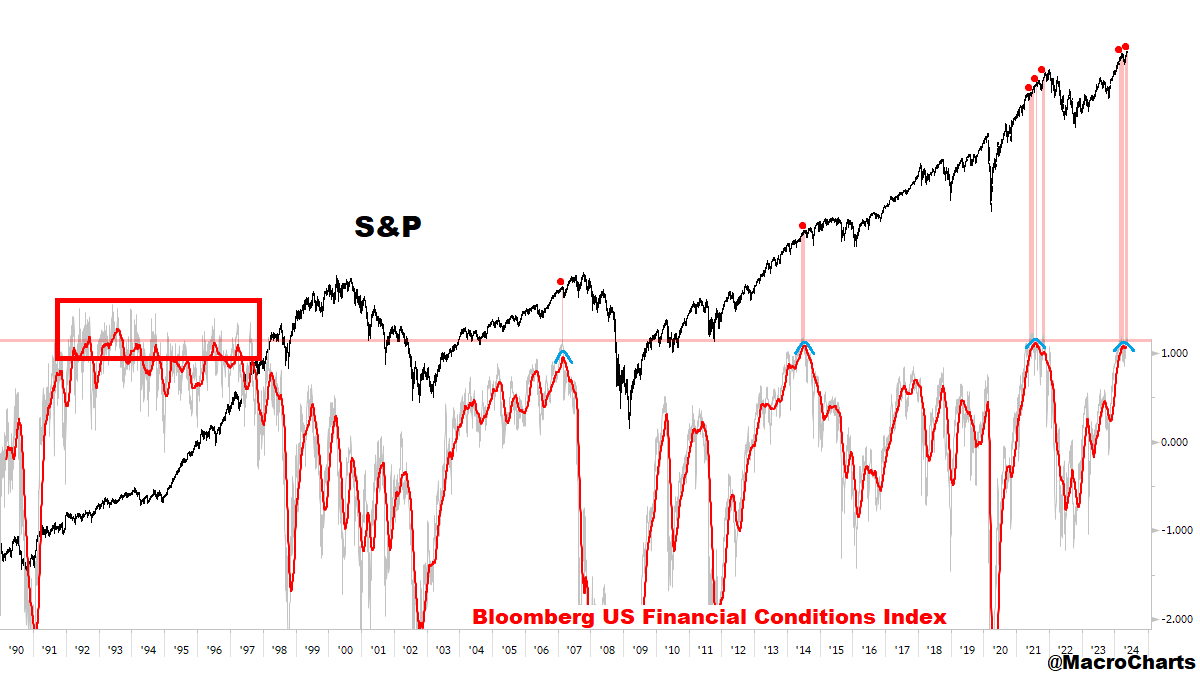

*I monitor all of the key FinCon indexes — this is Bloomberg’s version, which I like to compare to the Fed’s for confirmation/divergence.

Financial Conditions aren’t “too easy” as the Fed suggested — they’re “let’s-all-go-swim-naked easy”.

In 2007, 2014 and 2021, easy money led to hard times over the next 1-2 years in all three cases.

Importantly, Financial Conditions today may have already peaked and are turning DOWN, similar to those three Major peaks.

Only once in history were Financial Conditions this loose and with little consequence — during the Internet Revolution, and massive globalization & demographic tailwinds of the 90s. You could argue the AI revolution will be similar to the Internet, but globalization & demographics have reverted to headwinds in most of the world, so it’s not quite the same as the roaring 90s.

History says that eventually, today’s loose financial conditions will matter a great deal.

But I don’t commit capital to ideas that will pay off “eventually”.

We could talk about the Fed’s reaction function all day, or we can focus on what markets are doing right now.

Remember, it’s all good until markets say otherwise — price leads, and policymakers follow.

A number of markets have my full attention here, suggesting the foundation is becoming fragile.

As I proposed recently, and detailed in key conditions to watch, prices are beginning to say “otherwise”:

Keep reading with a 7-day free trial

Subscribe to Macro Charts to keep reading this post and get 7 days of free access to the full post archives.