ONWARDS

Six months ago, I started writing again and joined Substack.

In 2023, supporters and friends on Twitter/X noticed I had to take a step back.

It wasn’t an easy period.

I had personal challenges to resolve, and some difficult choices to make.

It took time, but gradually things got better — and I came back.

Earlier this year, I reached out to friends who recommended checking out Substack, and the rest is history.

UPWARDS

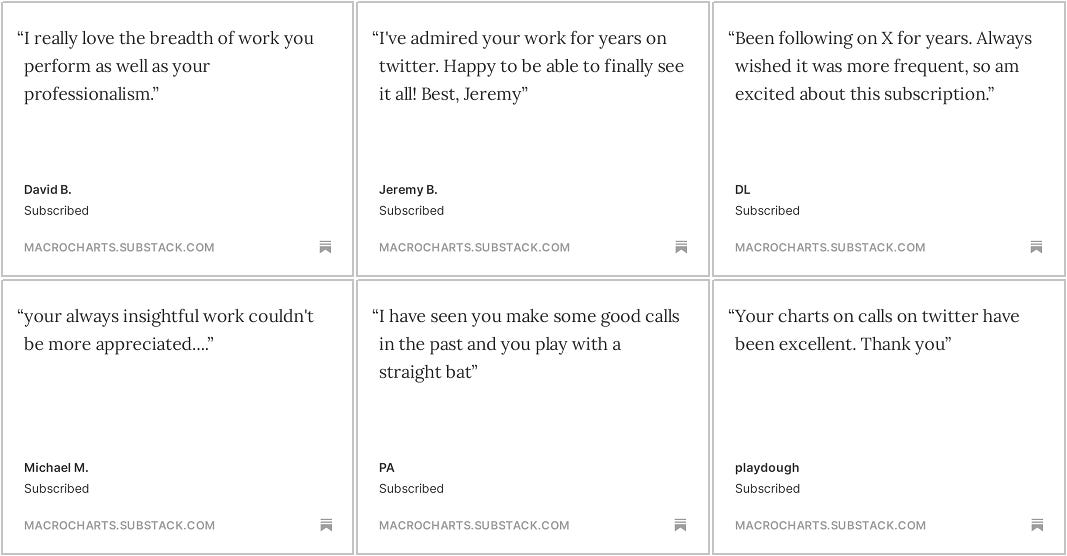

The decision to join Substack far exceeded my expectations…

Macro Charts is ranked among the platform’s TOP 40 Financial publications — and climbing rapidly.

This week, we were also selected to be a Substack FEATURED PUBLICATION.

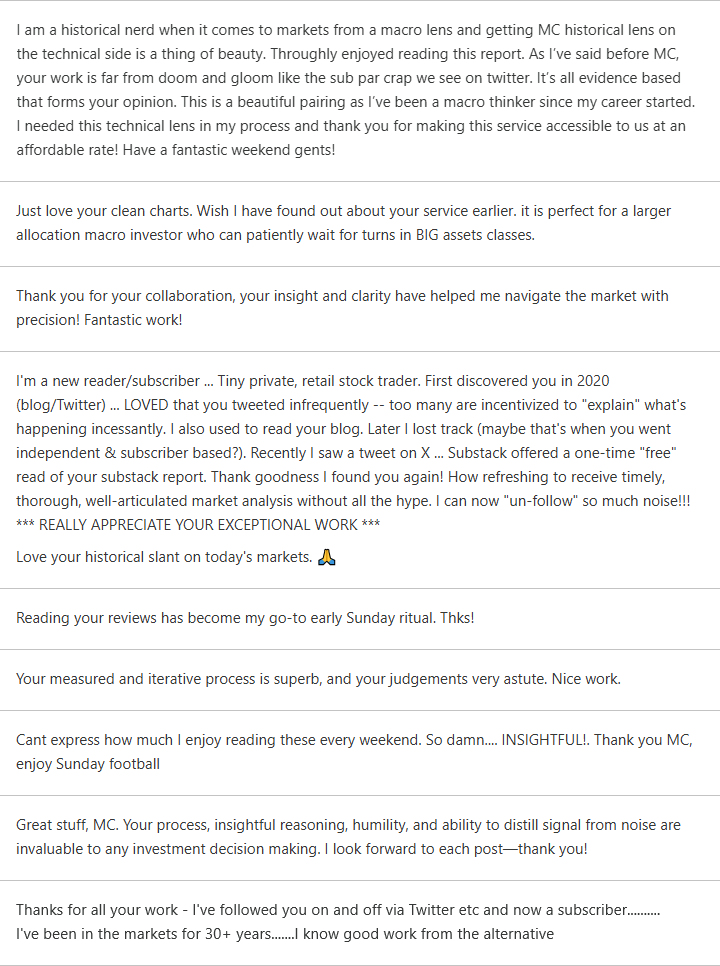

To all our loyal Subscribers — THANK YOU for your support.

Our goal is to build one of the top Market Charts & Data communities here, serving investors all over the world.

Every day for the past 30+ years in markets, I've worked tirelessly to develop and improve my investment process — staying disciplined, focused on BIG trends & ideas, and the biggest moves in markets.

It’s been a long journey — after sharing my work freely on Twitter/X for many years, I’m lucky to publish my best ideas here in full.

What will markets do over the next decades? We’ll be here, studying them with same excitement as always.

DO YOUR BEST, AND GREAT PEOPLE WILL NOTICE

I’ve always believed in the power of hard work and persistence.

As a result of a LOT of hard work this year — a LOT of great people have noticed.

A list of some of our proudest Research achievements this year:

U.S. EQUITIES. Core Models triggered Sells close to the S&P’s March top, triggered Buys at the April bottom, triggered Sells close to the July top and triggered Buys at the August bottom — altogether, these were meaningful swings in the Stock Market. I could have been more aggressive in trading them — but at least the signals did their job. Study, learn, improve…

CHINA TECH STOCKS. One of the reasons I started writing again, was to highlight this potential major opportunity to the world. In May, I presented the case for a new China Bull Market unfolding — a view I had held for months. After patiently tracking the market until September, we published several alerts as my signals lit up “ALL SYSTEMS GO” — which led to one of the most powerful rallies in the history of the Chinese market. As prices spiked into October, a day before the initial Top I shared my concerns that speculative flows were at extreme levels and in need of an extended consolidation. As before, we’ll continue tracking for another entry opportunity, following the longer-term Bullish thesis — stay tuned.

BOND YIELDS. After being in the “higher for longer” camp the last few years, in June I began writing about a Major shift to lower Yields — since then, the 2-Year Yield (my focus area at the time) fell -150bps to our targets of 3.50% (from 5.00%), where again we shifted gears for Tactically higher Yields into year-end — and focused on 30YR Bond Yields, which widened nearly +70bps since. But the year’s not over yet — and as I’ve been writing recently, there may be *another* surprise coming…

YIELD CURVE. Also in June, I highlighted 2s10s embarking on what could be a Major steepening trend — and described it as “maybe the best Rates trade of the year”. Since then, the curve steepened nearly +75bps, the biggest move of 2024. I suspect next year will have even bigger opportunities — so we’ll be watching with close interest.

USDJPY. In June and July, after being Bullish more than a year, as USDJPY tested 160 I began writing about the risks of a potential Carry Trade unwind, which could contaminate markets. Over the next 2 months Dollar-Yen plunged nearly 14%, dragging Global Equities with it, and ultimately reached targets around 140. Near the bottom in mid-September, I began looking for a potential sharp rally, with significant higher targets in the ~152-154 range. The rally began soon after, and these targets, though far at the time, were ultimately achieved in six weeks. What’s next? We think opportunities in Japan and USDJPY are just beginning, and as I wrote in the summer, we may be on the cusp of a multi-year shift in Japan and Global Liquidity — with big implications for asset classes everywhere. An understanding of Macro, Flows and Technical trading could be essential.

USDBRL. Soon after starting the Substack, I issued a Special Report on the potential for the Dollar to launch a massive multi-year rally against the Brazilian Real. At the time, USDBRL was trading at 5.13 and soon began a vertical, two month rally which peaked at 5.85 (for now). Near the peak, we wrote that initial targets had been achieved and an extended consolidation was likely. Longer-term, I still think there’s significant opportunity in this pair (as discussed in the May report) — and we’ll continue to focus on the big swings as we go.

OIL. After being mostly constructive Oil & Energy in the first half of 2024, by June/July I gradually became more concerned. Ultimately we sidestepped a $20 decline in Crude, and a day after the September low, I published a shift in thinking — for a potential $10-15 bounce in Oil prices into later Q4. This estimated rally was achieved a month later. Price action since then has been disappointing, and Oil gave back most of its rally. But as before, no one seems interested… so my contrarian sense says let’s watch closely, especially with what’s happening in China.

THE NEXT BIG IDEA… As regular readers know, we are currently focused on what could be a massive Trend opportunity developing in a number of key Markets. The world is changing rapidly again. It feels like the next 6-12 months could be filled with opportunities and challenges. I look forward to studying what Markets are saying, and where they might go.

For New Readers: a summary of recent Core Views & Analysis can be found here, here and here.

THE MC COMMUNITY

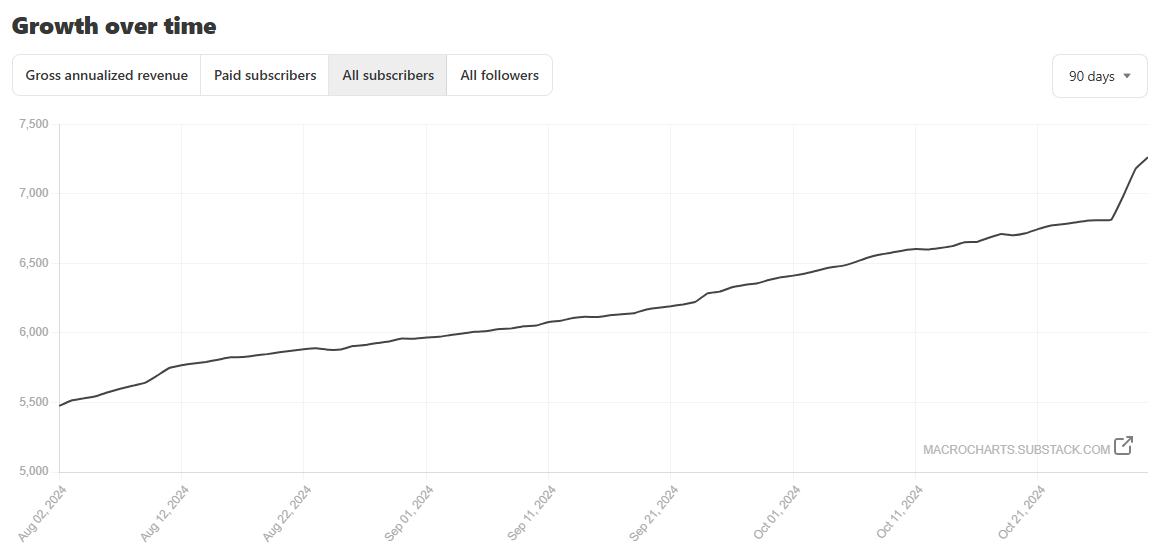

Six months after we started, the MC Community is 7,000+ strong and growing rapidly.

Thanks to you, our community could be one of the largest audiences on Finance Substack in the next few years.

I’m ALL-IN — thanks to you, we have one of the highest rates of conversion to Paid Subscribers AND Subscriber retention rates on Substack — readers GET the value proposition, and are ALL-IN with us.

The initial goal was “1-2 reports per week”, but we’re already up to 80 posts in 6 months!

And there’s MUCH MORE to come…

THANK YOU FOR BEING A LOYAL READER

If you’re a Free or Paid Subscriber, I’d like to ask ONE QUICK FAVOR:

*Please share this post with friends — it would be a big help.*

And if you’re a Paid Subscriber, stay tuned — we’re working on some amazing new ideas, including:

NEW DATASETS which I’ve long wanted to build, and finally have the time to develop — get ready for more unique, “never-before-seen” charts in the classic “MC STYLE”!

IN ADDITION to the flagship Weekly Review, Mid-Week Update, Thematic Updates and Charts of The Week, I’ll be adding several NEW recurring series — such as BEST & WORST (released this month), and a LOT more…

We’re just getting started — stay tuned!

MC this is well deserved.

Your hard work stands out with deep, clarity and discipline.

A macro-size following in the making here, MC. I’m very grateful to be a part of it. The only worry you must have is how your success will make it hard to be a contrarian when you’re the head of The Herd!