30+ updated Charts & Commentary on all major Markets — for your review.

INTRODUCTION

“Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes.” — Jesse Livermore

ON MOMENTUM AND HISTORY

Market history is filled with Manias and Bubbles which ultimately exhausted, and those reversals brought hard, painful lessons for investors. These cycles will likely repeat forever, because human nature never changes.

As I wrote in July, while Bubbles accelerate into their final Top, investors embrace a mass “cognitive bias chase” for upside Beta. For a brief moment of collective and subjective reality, everyone’s a genius Alpha stock-picker. But then the tide turns, and the reality of downside Beta kicks in. Easy money turns into hard losses.

History shows that on the other side of an exponential move, markets almost always undergo an extended Momentum Crash. Momentum Crashes typically go through at least three stages — the first stage is an initial crack, which occurred in July-August.

The second phase of a Momentum Crash exhibits a typical pattern: a powerful but increasingly fractured bounce (more on this later), with sentiment growing even more Bullish than it was at the Top — but in reality, the peak was already in.

“Earnings watch parties” may well have been the classic tell for the second phase of this cycle. The party raged on, but the top was already in, and negative Momentum was right around the corner.

After the failed bounce, downside acceleration (the third stage) took hold, and negative Momentum triggered some of the most destructive declines in history. Some former leading Stocks, considered invulnerable leaders of the new age, went through catastrophic drawdowns of 70-90%. Some never recovered from those declines, others took decades to climb back to old highs, and others went to zero (fraud / bankruptcy).

THOUGHTS & OBSERVATIONS

I don’t like to be Bearish, and wish there were better news.

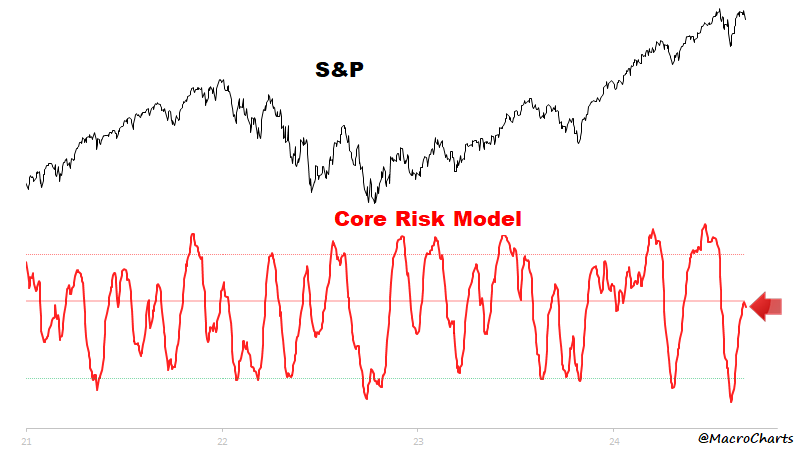

But as shared in recent reports “Stocks on the Edge” and “Hanging By a Thread”, markets look vulnerable.

This could accelerate into another round of global deleveraging.

THIS IS ONE OF THOSE RARE MOMENTS WHERE:

Keep reading with a 7-day free trial

Subscribe to Macro Charts to keep reading this post and get 7 days of free access to the full post archives.