EXECUTIVE SUMMARY — NEW SIGNALS & COMMENTS

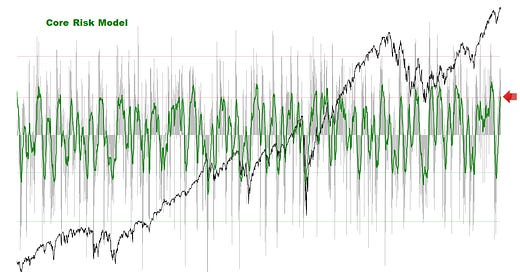

The Stock rally which began at the April 19 lows — when Core Models were Bullish — may soon be over.

Topping structures may take some days, but for the groups that matter (and are exhibiting clear Negative Momentum), the rally looks largely over.

Weakness has been spreading in key areas — a leading indicator.

The list of important Stocks with Negative Momentum is expanding.

We’ll cover the signals I’m watching to confirm an important turn.

Some could potentially confirm as early as next week.

I’ll update if / when they trigger.

Rates, the Dollar and Volatility are at an important juncture.

Bond Yields and the Dollar are showing signs of a classic Trend extension.

We’ll update the key charts from Thursday’s post, and expand on several new signals & ideas.

Signals are triggering without delay — a subtle, but important change in tone.

Oil and Energy Stocks haven’t shown relative strength yet, but the potential is still there.

Metals are developing a potential reversal pattern — as discussed earlier this week.

Crypto remains constructive for now.

Keep reading with a 7-day free trial

Subscribe to Macro Charts to keep reading this post and get 7 days of free access to the full post archives.