This article published today on Bloomberg perfectly captures the current sentiment by China’s retail investors — and is worth reading in full:

*Highlights are mine:

China Investors’ New Nickname Shows Frustration With Market Rout

2024-07-09 06:31:51.795 GMT

(Bloomberg) — Some of China’s 200 million mom-and-pop investors have given themselves a sarcastic new nickname in a show of frustration with the country’s failure to prop up the stock market.

Lamenting the lack of returns, they call themselves “financial consumers.” Chinese regulators used the term on June 28 when it vowed to protect the rights of those who buy financial products, but pessimistic investors adopted the saying to express their disappointment as a rally in Chinese equities that began earlier this year fizzled out. Related searches have spiked since late last month on social media sites including WeChat.

“We’re not investors. We have a new identity called consumer,” said an investment commentator in a video liked 14,000 times on Douyin. “Don’t think about making a profit. You should think of yourself as a consumer spending money.”

The moniker encapsulates the sense of pessimism as China’s benchmark index for domestic shares erased this year’s gains ahead of a key policy meeting next week.

Bearish signs continue to mount ahead of the Communist Party’s third plenum, a gathering closely watched by investors for major policy shifts. Mainland’s benchmark CSI 300 suffered a seventh week of losses on Friday, its longest losing run since 2012. In Hong Kong, the Hang Seng China Enterprises Index touched the lowest since April before paring losses on Tuesday.

“Let’s get our position right and do a good job as a financial consumer,” one person wrote on China’s microblogging platform Weibo on Monday. “As long as we support the national team to make money, we are like supporting the country.”

“National team” is an informal name for a group of exchange-traded funds favored by China’s sovereign wealth fund to prop up the stock market during a slump.

Some social media users said the term adds to an older, self-deprecating name “chives,” a plant that keeps popping back up after being harvested, a metaphor for exploited small investors.

Notes & Observations

As mentioned briefly before and worth noting again, the CCP meets next week (July 15) for its third plenum — a once-in-five-years gathering of top officials.

Historically, these conclaves led to major economic and political policy change.

We’ll see what major new policy initiatives come out next week… my best guess is that significant new resources could be made available to champion Chinese technology companies, which are considered key to the CCP’s future strategic goals.

Consultants and analysts I’ve spoken with, who are well-connected and informed on the local front, are still fairly divided on what could come out of this meeting. Some are unusually skeptical, arguably even pessimistic that meaningful changes will be announced. In other words, the bar has been set very low.

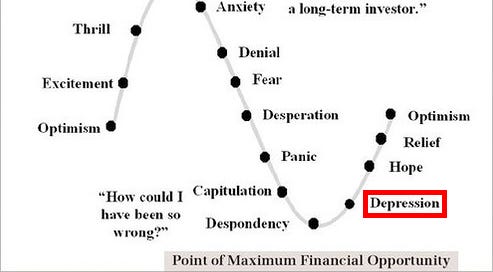

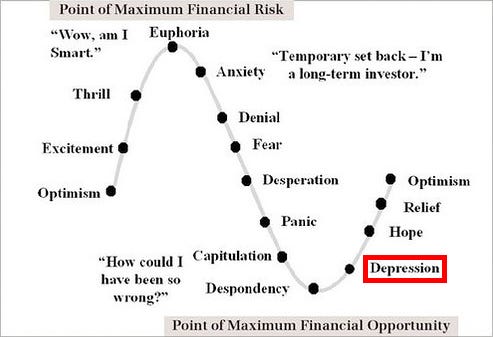

Meanwhile, despite investor sentiment at depression levels, the key Stocks I’ve been focused on remain in position to resume their Bull trends — and could be close to triggering new Buy signals — a classic Bull Market continuation pattern.

If and when these Buy signals finally start lighting up on my screens, we may be at another key inflection point. It won’t take much to do this, so these Stocks have my full attention.

Altogether, very little is needed to surprise the market’s depressed expectations. All the CCP has to do is not drop the ball, for once.

Thanks for reading.

If you were forwarded this email and are not yet a subscriber, consider signing up and supporting us:

China is cheap for sure, but there are some pretty significant structural issues in the economy, which make a sustained bull market unlikely IMO. The main issue is the deflating property bubble that Xi is unwilling to address heads on (as any solution comes at a cost - such as devaluation - which is unacceptable for now), but there are also broader issues of rule of law, and capital flight. Wealthy Chinese often have one objective - to put their assets in a safe jurisdiction abroad, as they are potentially at risk in China. If Jack Ma can be sidelined and blackmailed, so can anyone else. These phenomena are not new, but have intensified.

I have traded China & HK stocks successfully earlier this year on the long side, and there will surely be more trading opportunities, but this is not the beginning of a sustained bull market IMO.

I know BABA's buybacks and FCF generation look great, other companies are cheap too, but I'm not sure being cheap is enough given the scale of the challenges at hand.