CHART OF THE WEEK:

A long way since “un-investable”.

China HSI — biggest decline since 2008, among the worst in *60* years.

I shared my concerns this weekend, in Global Markets — Weekly Review 24:

SPECIAL UPDATE ON CHINA (CONTINUED)

A historic run — but has the juice been squeezed, and is it time to STEP AWAY?

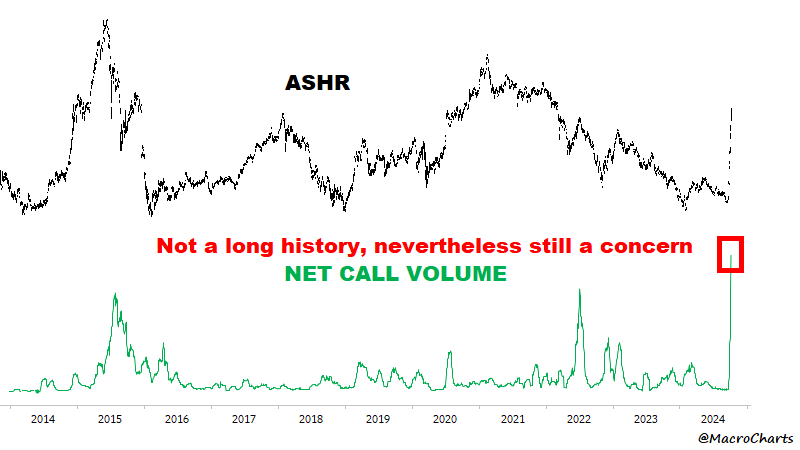

Speculative Call Volumes are a big concern here — I don’t like setups like these, and history has shown significant risk in similar conditions.

After being Bullish on China most of the year, at this point the optimal course of action for me is to significantly reduce allocations, and if a high-volume reversal is seen, cut down all exposure.

I don’t say this lightly as it’s been an important area of focus, and it could still have long-term upside potential — but managing risk comes first.

BIG PICTURE:

Chinese Stocks have come a long way since “un-investable”...

Not long ago (earlier this year), having a Bullish view on China wasn’t considered an intelligent thing to do.

Now in just the last two days, all the big Wall Street firms are upgrading targets aggressively — and everyone is chasing more upside.

Meanwhile — flashing on my screens, my charts suggest China is again at an important crossroads (link), with enough reasons to rethink the Bullish case for now.

“The stock market is a device for transferring money from the impatient to the patient.” (Warren Buffett)

I *continue* to think there will be plenty of opportunities to re-engage in this big Chinese Bull Market — but TIME and PATIENCE are likely needed to get a better entry point.

Things got way too easy — now comes the hard part.

Meanwhile, there are plenty of markets and opportunities which still grab my attention — and there’s more than enough time left in 2024 for “surprises”.

Onwards and upwards, -MC

Thanks for reading.

you are amazing, thank you

i think profit taking is expected after this initial thrust .we are at the beginning of new bull market to take all time high in chines stocks.